payment integration

With MAP, you get a processing platform that leverages cutting-edge technology and provides exceptional service. We are a proven thought leader, evidenced by our position at the forefront of payment innovation, and strive to help you gain long-term success. Working with our partners, MAP connect credit union to a payments universe, supporting an institution’s full spectrum of payment processing needs.

For more than a quarter century, we’ve worked hard to make processing easier for credit unions. With MAP, our clients stay innovative, stay agile and deliver at scale. In today’s market, this is a critical need. We provide our clients with a comprehensive solution and single point of access to Visa payment products and services, as well as other global capabilities.

APIs and SDKs

Open up a new world of possibilities with MAP's Developer Tools & Solutions

APIs make it possible for applications to interact and share data with each other. MAP partners with Visa and Visa DPS to offer a full suite of APIs, which enable our clients and vendors to share data as appropriate for their business needs.

In consultation with your core software provider and your digital asset vendor, MAP can outline a strategy for launching the applicable APIs. Available Visa APIs and technical specifications are available via the Visa Developer Center (developer.visa.com).

The Visa API set includes:

- Transaction Alerts

- Consumer Transaction Controls

- Visa Token Service

- Visa Risk Manager

- Visa Direct

Visa DPS API set includes:

- Falcon List

- Card & Account Maintenance

- VROL for DPS

Implementations and Conversions

MAP is uncompromising in providing successful conversions.

Implementations and Conversions

MAP prides itself on the comprehensive nature of its product implementations and core conversions. Working with a dedicated implementation manager, the credit union with be entrusted to time-tested methodologies and innovative approaches to result in a successful conversions.

Key activities include requirements definition, application configuration, certification, change management, pilot, and production phases. Your manager will take care to coordinate support from pertinent vendors and partners, provide go-live support to ensure that the change is invisible to your cardholders, document implementation details, and ensure a smooth transition from the implementation process to ongoing production support.

You’re always in good hands when working with the MAP Implementations Team.

Testing and Certification

Delivering confidence with MAP's Robust & Thorough testing and certification

MAP’s comprehensive Certification and Testing delivers confidence that the breathe of the credit union’s card and payment programs will perform to the highest standards. MAP’s rigorous process provides a competitive edge over other processors, ensuring the reliability, security, compliance and interoperability to boost member adoption and usage across the credit union.

MAP’s Certification and Testing is robust and thorough. During this phase of the implementation all aspects of the credit union’s project are tested in a certification environment. MAP works with all parties involved prior to the start of certification to ensure each partner is prepared and that their expectations clearly identified and documented.

Credit unions can be assured that payment solutions certified and tested by MAP will function reliably and securely in production.

ISO 8583 and ISO 2002

MAP is Miles Ahead of the competition

ISO 8583 is an international standard for the exchange of card-based transaction messages globally, providing a foundation for secure and reliable electronic payment processing. It defines a messaging format used for exchanging electronic data between different systems involved in card-based financial transactions, such as point-of-sale (POS) terminals, automated teller machines (ATMs), and card issuing systems. ISO 8583 has a history that dates back to 1987 when the initial version of ISO 8583 was published. MAP and Visa employ the ISO 8583 framework for structuring and exchanging messages related to card-based financial transactions.

Future Ready

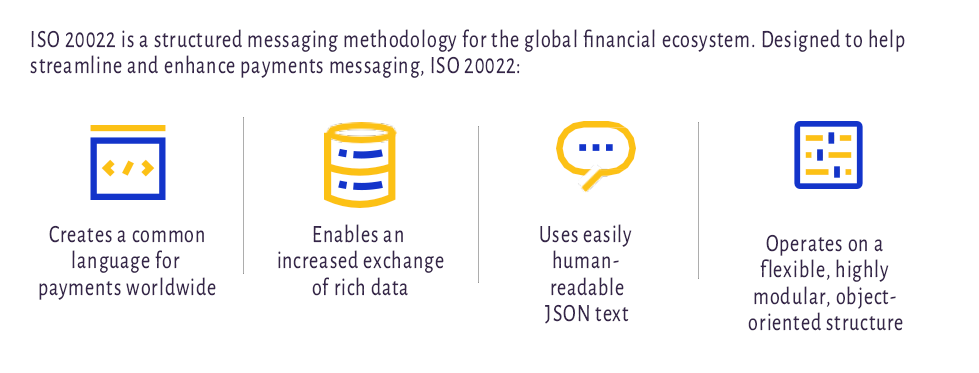

ISO 20022 represents an evolutionary leap in payments communication. Similar to how streaming video platforms won out over brick-and-mortar video rental stores by offering a better, faster and more accessible user experience, ISO 20022 is the next generation of financial messaging, allowing for the expansion of data elements currently not available through the ISO 8583 payload, opening up opportunities for new use cases. ISO 20022 provides a cleaner, easier-to-use messaging standard that is significantly more versatile and user-friendly than the legacy ISO 8583 standard initially developed in the 1980s.

Our processing partner, Visa DPS, has been designing solutions and building messages in the ISO 20022 standard for more than three years, providing input and feedback to the ISO 20022 working group that has influenced message content and informed the ongoing development of the standard. As a market leader in ISO 20022 integration and development, Visa DPS is working with MAP to help guide credit unions as they start preparing for adoption.